Electronic Arts Reports Q4 and FY24 Results

EA SPORTS™ Momentum Continued in FY24, Company Delivers Record Fiscal Year Cash Flow

May 7, 2024

REDWOOD CITY, CA – May 7, 2024 – (NASDAQ: EA) today announced preliminary financial results for its fourth quarter and fiscal year ended March 31, 2024.

“This year, EA delivered bigger, bolder world class entertainment that engaged and connected hundreds of millions of players and fans,” said Andrew Wilson, CEO of EA. “We will continue to build on this strong momentum through an incredible pipeline of new experiences, starting with College Football in FY25, positioning us for accelerated growth in FY26 and beyond.”

“EA’s FY24 was highlighted by record cash flow and strong earnings growth driven by EA SPORTS FCTM and Madden NFL,” said Stuart Canfield, CFO of EA. “With strong conviction in our future, we are announcing an expanded stock repurchase program. We look forward to sharing more about our long-term strategy and financial framework at our Investor Day this fall.”

Selected Operating Highlights and Metrics1

- Net bookings2 for FY24 was $7.430 billion, up 1% year-over-year (up 3% in constant currency).

- Delivered 11 titles and over 600 content updates in the year, including four non-annual sports titles and the successful rebrand of EA SPORTS FC.

- Our global football franchise grew net bookings by high-teens percent in FY24.

- During FY24, our EA SPORTS™ Madden NFL franchise delivered record net bookings, up 6% year-over-year and double-digit growth in weekly average users for both Madden NFL 24 and Madden Mobile.

Selected Financial Highlights and Metrics

- Net revenue for FY24 was $7.562 billion, up 2% year-over-year.

- For FY24, net cash provided by operating activities was a fiscal year record $2.315 billion, up 49% year-over-year.

- During FY24, EA returned $1.505 billion to stockholders through stock repurchases and dividends.

- The board has authorized a new stock repurchase program of $5 billion over three years.

Dividend

EA has declared a quarterly cash dividend of $0.19 per share of the Company’s common stock. The dividend is payable on June 19, 2024 to stockholders of record as of the close of business on May 29, 2024.

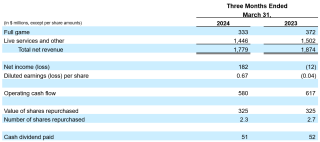

Quarterly Financial Highlights

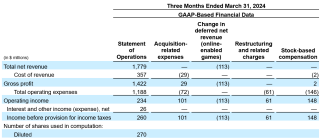

The following GAAP-based financial data3 and tax rate of 19% was used internally by company management to adjust its GAAP results in order to assess EA’s operating results:

Fiscal Year Financial Highlights

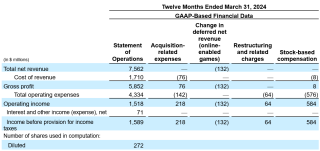

The following GAAP-based financial data3 and a tax rate of 19% was used internally by company management to adjust its GAAP results in order to assess EA’s operating results.

Operating Metric

The following is a calculation of our total net bookings2 for the periods presented:

Business Outlook as of May 7, 2024

Fiscal Year 2025 Expectations – Ending March 31, 2025

Financial outlook metrics:

- Net revenue is expected to be approximately $7.100 billion to $7.500 billion.

- Change in deferred net revenue (online-enabled games) is expected to be approximately $200 million.

- Net income is expected to be approximately $904 million to $1.085 billion.

- Diluted earnings per share is expected to be approximately $3.34 to $4.00.

- Operating cash flow is expected to be approximately $2.050 billion to $2.250 billion.

- The Company estimates a share count of 271 million for purposes of calculating diluted earnings per share.

Operational outlook metric:

- Net bookings2 is expected to be approximately $7.300 billion to $7.700 billion.

In addition, the following outlook for GAAP-based financial data3 and a tax rate of 19% are used internally by EA to adjust GAAP expectations to assess EA’s operating results and plan for future periods:

First Quarter Fiscal Year 2025 Expectations – Ending June 30, 2024

Financial outlook metrics:

- Net revenue is expected to be approximately $1.575 billion to $1.675 billion.

- Change in deferred net revenue (online-enabled games) is expected to be approximately ($425) million.

- Net income is expected to be approximately $197 million to $243 million.

- Diluted earnings per share is expected to be approximately $0.73 to $0.90.

- The Company estimates a share count of 270 million for purposes of calculating diluted earnings per share.

Operational outlook metric:

- Net bookings2 is expected to be approximately $1.150 billion to $1.250 billion.

In addition, the following outlook for GAAP-based financial data3 and a tax rate of 19% are used internally by EA to adjust GAAP expectations to assess EA’s operating results and plan for future periods:

Conference Call and Supporting Documents

Electronic Arts will host a conference call on May 7, 2024 at 2:00 pm PT (5:00 pm ET) to review its results for the fourth fiscal quarter and fiscal year ended March 31, 2024 and its outlook for the future. During the course of the call, Electronic Arts may disclose material developments affecting its business and/or financial performance. Listeners may access the conference call live through the following dial-in number (888) 330-2446 (domestic) or (240) 789-2732 (international), using the conference code 5939891 or via webcast at EA’s IR Website at http://ir.ea.com.

EA has posted a slide presentation with a financial model of EA’s historical results and guidance on EA’s IR Website. EA will also post the prepared remarks and a transcript from the conference call on EA’s IR Website.

A dial-in replay of the conference call will be available until May 22, 2024 at (800) 770-2030 (domestic) or (647) 362-9199 (international) using conference code 5939891. An audio webcast replay of the conference call will be available for one year on EA’s IR Website.

Forward-Looking Statements

Some statements set forth in this release, including the information relating to EA’s expectations under the heading “Business Outlook as of May 7, 2024” and other information regarding EA's expectations contain forward-looking statements that are subject to change. Statements including words such as “anticipate,” “believe,” “expect,” “intend,” “estimate,” “plan,” “predict,” “seek,” “goal,” “will,” “may,” “likely,” “should,” “could” (and the negative of any of these terms), “future” and similar expressions also identify forward-looking statements. These forward-looking statements are not guarantees of future performance and reflect management’s current expectations. Our actual results could differ materially from those discussed in the forward-looking statements.

Some of the factors which could cause the Company’s results to differ materially from its expectations include the following: sales of the Company’s products and services; the Company’s ability to develop and support digital products and services, including managing online security and privacy; outages of our products, services and technological infrastructure; the Company’s ability to manage expenses; the competition in the interactive entertainment industry; governmental regulations; the effectiveness of the Company’s sales and marketing programs; timely development and release of the Company’s products and services; the Company’s ability to realize the anticipated benefits of, and integrate, acquisitions; the consumer demand for, and the availability of an adequate supply of console hardware units; the Company’s ability to predict consumer preferences and trends; the Company’s ability to develop and implement new technology; foreign currency exchange rate fluctuations; economic and geopolitical conditions; changes in our tax rates or tax laws; and other factors described in Part II, Item 1A of Electronic Arts’ latest Quarterly Report on Form 10-Q under the heading “Risk Factors”, as well as in other documents we have filed with the Securities and Exchange Commission, including our Annual Report on Form 10-K for the fiscal year ended March 31, 2023.

These forward-looking statements are current as of May 7, 2024. Electronic Arts assumes no obligation to revise or update any forward-looking statement for any reason, except as required by law. In addition, the preliminary financial results set forth in this release are estimates based on information currently available to Electronic Arts.

While Electronic Arts believes these estimates are meaningful, they could differ from the actual amounts that Electronic Arts ultimately reports in its Annual Report on Form 10-K for the fiscal year ended March 31, 2024. Electronic Arts assumes no obligation and does not intend to update these estimates prior to filing its Form 10-K for the fiscal year ended March 31, 2024.

About Electronic Arts

Electronic Arts (NASDAQ: EA) is a global leader in digital interactive entertainment. The Company develops and delivers games, content and online services for Internet-connected consoles, mobile devices and personal computers.

In fiscal year 2024, EA posted GAAP net revenue of approximately $7.6 billion. Headquartered in Redwood City, California, EA is recognized for a portfolio of critically acclaimed, high-quality brands such as EA SPORTS FC™, Battlefield™, Apex Legends™, The Sims™, EA SPORTS™ Madden NFL, Need for Speed™, Titanfall™, Plants vs. Zombies™ and EA SPORTS F1®. More information about EA is available at www.ea.com/news.

EA, EA SPORTS, EA SPORTS FC, Battlefield, Need for Speed, Apex Legends, The Sims, Titanfall, and Plants vs. Zombies are trademarks of Electronic Arts Inc. John Madden, NFL, FIFA and F1 are the property of their respective owners and used with permission.

For additional information, please contact:

Andrew Uerkwitz

Vice President, Investor Relations

650-674-7191

auerkwitz@ea.com

Erin Rheaume

Director, Financial Communications

650-628-7978

erheaume@ea.com

1 For more information on constant currency, please refer to the earnings slides available on EA’s IR Website.

2 Net bookings is defined as the net amount of products and services sold digitally or sold-in physically in the period. Net bookings is calculated by adding total net revenue to the change in deferred net revenue for online-enabled games.

3 For more information about the nature of the GAAP-based financial data, please refer to EA’s Form 10-K for the fiscal year ended March 31, 2023.

RELATED NEWS

Electronic Arts Reports Strong Q2 FY25 Results

Electronic Arts Reports Strong Q1 FY25 Results

Electronic Arts Reports Strong Q3 FY24 Results

* Requires FIFA 23 (sold separately), all game updates, internet connection & an EA Account.

** Conditions and restrictions apply. See https://www.ea.com/games/fifa/fifa-23/game-offer-and-disclaimers for details.

*** CONDITIONS, LIMITATIONS AND EXCLUSIONS APPLY. SEE EA.COM/EA-PLAY/TERMS FOR DETAILS.